What Credit Bureau Does Target Use

impress this folio

TR-PP-005 Rev. 1/19

TGITCCD05-0119

| FACTS | WHAT DOES TD BANK USA, Due north.A. ("TD Depository financial institution") Practice WITH YOUR TARGET CREDIT CARD PERSONAL Data? |

|---|---|

| Why? | Fiscal companies cull how they share your personal information. Federal law gives consumers the right to limit some but non all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Delight read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with the states. This information can include: - Social Security number and income- account balances and payment history - credit history and credit scores - account transactions |

| How? | All fiscal companies need to share customers' personal data to run their everyday business organisation. In the section below, nosotros listing the reasons fiscal companies can share their customers' personal information; the reasons TD Bank chooses to share; and whether you can limit this sharing. |

| Reasons nosotros can share your personal information | Does TD Bank share? | Tin yous limit this sharing? |

|---|---|---|

| For our everyday business purposes— | Yes | No |

| For our marketing purposes— | Yes | No |

| For joint marketing with other financial companies | Yes | No |

| For our affiliates' everyday business purposes— | Yep | No |

| For our affiliates' everyday business purposes— | No | Nosotros don't share unless you lot provide consent |

| For our affiliates to market to y'all | No | We don't share unless you provide consent |

| For non-affiliates, other than Target, to market to you | Yes | Yes |

| For Target to market to you Annotation: Target is a non-chapter of TD Bank | Yes | Yeah |

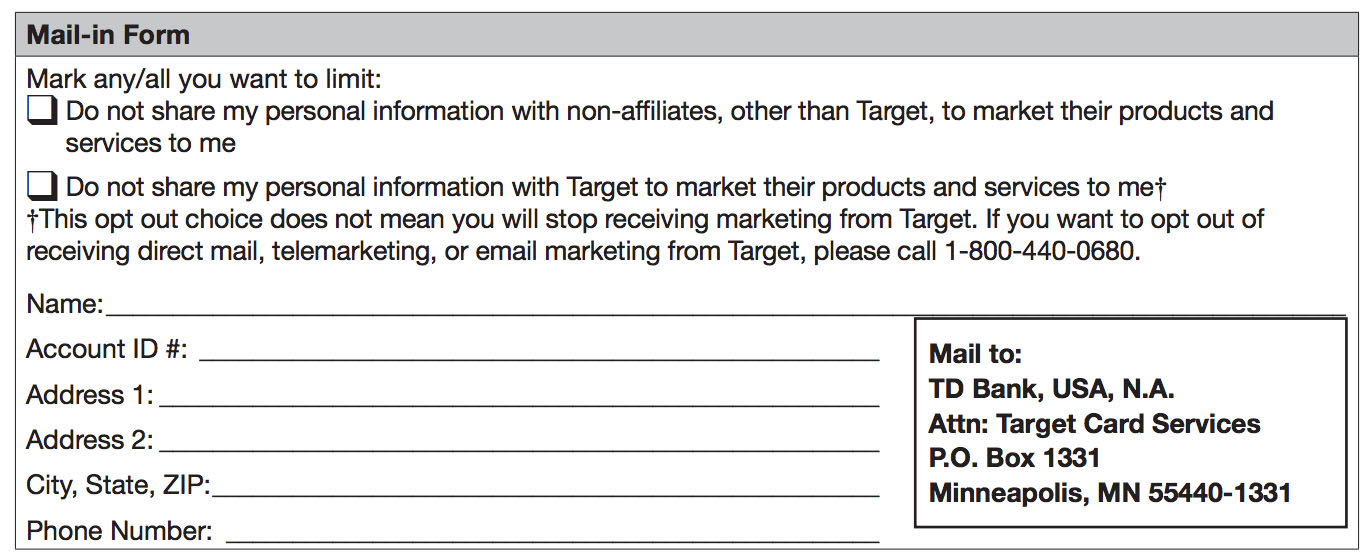

| To limit our sharing | - Call toll-gratuitous at one-800-462-8731. Our carte will prompt you through your choice(due south). - Mail the form below. Please note: |

|---|

| Questions? | Call toll-free at 1-800-424-6888 |

|---|

| Who we are | |

|---|---|

| Who is providing this notice? | This notice is provided by TD Bank solely with respect to your Target Carte du jour. This find applies only to your Target Carte du jour account issued past TD Bank and does non utilize to whatsoever other accounts you have with TD Bank or its affiliates. |

| What we exercise | |

| How does TD Banking company protect my personal information? | To protect your personal information from unauthorized access and use, we apply security measures that comply with federal constabulary. These measures include computer safeguards and secured files and buildings. |

| How does TD Bank collect my personal information? | We collect your personal information, for example, when you: - open an account or give us your contact information- use your credit card - provide account information - pay us by check We also collect your personal information from others, such every bit credit bureaus, affiliates, or other companies. |

| Why can't I limit all sharing? | Federal law gives you the correct to limit only: - sharing for affiliates' everyday business purposes—information about your creditworthiness

State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights nether land law. |

| What happens when I limit sharing for an business relationship I hold jointly with someone else? | Your choices will use to everyone on your account. |

| Definitions | |

| Affiliates | Companies related by common buying or control. They tin be financial and nonfinancial companies. - TD Bank'south affiliates include those companies that command, are controlled by or are under common control with TD Bank US Belongings Company or The Toronto-Rule Depository financial institution. |

| Non-affiliates | Companies not related by common buying or command. They can be financial and nonfinancial companies. - Non-affiliates we share with may include vendors of products and services that you have purchased, or that we believe will be of interest to you, financial service providers or not-profit organizations. - For example, Target is a not-affiliate of TD Banking concern. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market place fiscal products or services to y'all. - Our joint marketing partners may include other banks, investment firms or insurance companies. |

| Other important information | |

| Please keep in heed that we share data virtually y'all with Target for utilize in connexion with the Target Credit Bill of fare program and as otherwise permitted past law. They may utilize this information to maintain and service your account, create and update their records, to answer questions about your account and perform other Target Credit Card program functions or for other purposes permitted past law. Federal law does not requite you the right to limit such sharing. Target, or its affiliates, may too utilize the information nosotros share to provide yous with marketing offers. Y'all can limit this blazon of sharing, every bit described on folio 1 of this notice. We can modify our privacy notice at any time and volition allow y'all know if we do if/every bit required by applicative constabulary. | |

RedCard™: Target Debit Card™, Target Credit Menu™, and Target™; Mastercard®. Field of study to awarding approval (Target Mastercard not available to new applicants). The RedCard credit cards (Target Credit Card and Target Mastercard) are issued by TD Bank USA, Due north.A. The RedCard debit card is issued by Target Corporation. Mastercard is a registered trademark of Mastercard International, Inc. Pat seven,562,048 and eight,117,118.

What Credit Bureau Does Target Use,

Source: https://www.target.com/c/td-bank-privacy-policy-for-target-credit-card/-/N-4tgiy

Posted by: bellprelf1959.blogspot.com

0 Response to "What Credit Bureau Does Target Use"

Post a Comment